Beyond PSD2 for a Better Open Banking Expereince

PSD2 is acting as a catalyst in the digital transformation happening in the Banking industry. While meeting the compliance requirements of PSD2, financial institutes are excited to make use of the new business models and opportunities opened by this laid foundation. More the customers and partners we can reach, more the business activities and more the revenue. Making the banking functions more accessible and reactive will be a key enabler to provide a seamless experience to these parties, including internal banking staff whom directly affects the business efficiency.

IAM plays a critical role in improving business accessibility without compromising the system boundaries. PSD2 mandates strong customer authentication(SCA), setting the bar high for user authenticity, while keeping few exemptions, not to bother payment services user(PSU) with SCA for every little transactions. While adhering to this policy will make an institute PSD2 complaint, if they can react fast to the fraud rates fluctuations, utilizing the freedom given on SCA exemptions, it can act a business advantage. Also what if we select the factors for SCA in a context aware fashion and according a pre-configured user preference?

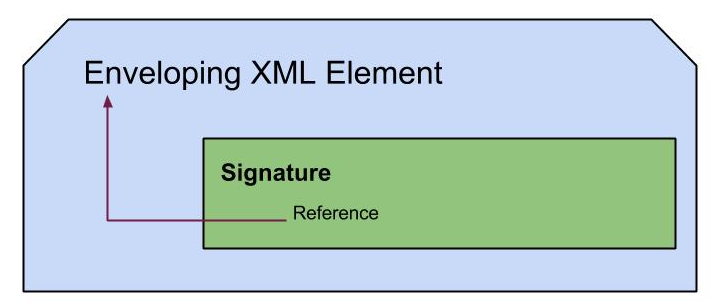

While SCA addresses the authenticity for PSU, API security addresses securely exposing banking functions to Fintecs including AISPs and PISPs. Supporting OIDC 1.0 based API security flows is plain sailing for the objective. How about having a smooth partner onboarding process, that captures all details for security checks there onwards (flexibility of making use of eIDAS network) and fine grained authorization policies for API access, along with OAuth2.0 and OIDC?

CIAM is a very sensitive aspect that need delicate handling as it’s governed by PSU’s choice as a whole and very strictly defined by PSD2 and GDPR enforcement to come. Precisely and concisely capturing user consent, honoring use consents in all business functions, providing consent mgt functionalities for both PSU and customer care officers, keeping trails of changes happened on consents and catering interoperability between consents captured by different parties still have space for more elegant solutions.