WSO2Con - 2011

WSO2Con - 2011, the event of the year!

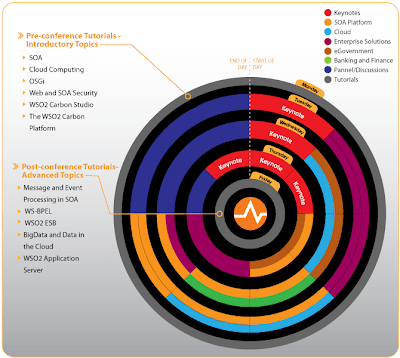

I found it a great a pleasure to have a chance to attend this event, which is to be a huge event in middle-ware industry with participations from Google, IBM and eBay and a perfect pool for technology lovers. Only few lucky students will get the chance to be there at student rates. But the great news is still you can reserve your place for a very low price regrading the value of this three-day conference with two more days in tutorials. Try and see whether you can catch the early bird rates too.

Check out event agenda and the registration page for more information. Here is what Dr. Sanjiva Weerawarna CEO-WSO2 has to say about the event.

I found it a great a pleasure to have a chance to attend this event, which is to be a huge event in middle-ware industry with participations from Google, IBM and eBay and a perfect pool for technology lovers. Only few lucky students will get the chance to be there at student rates. But the great news is still you can reserve your place for a very low price regrading the value of this three-day conference with two more days in tutorials. Try and see whether you can catch the early bird rates too.

Check out event agenda and the registration page for more information. Here is what Dr. Sanjiva Weerawarna CEO-WSO2 has to say about the event.