Identity Mediation for PSD2

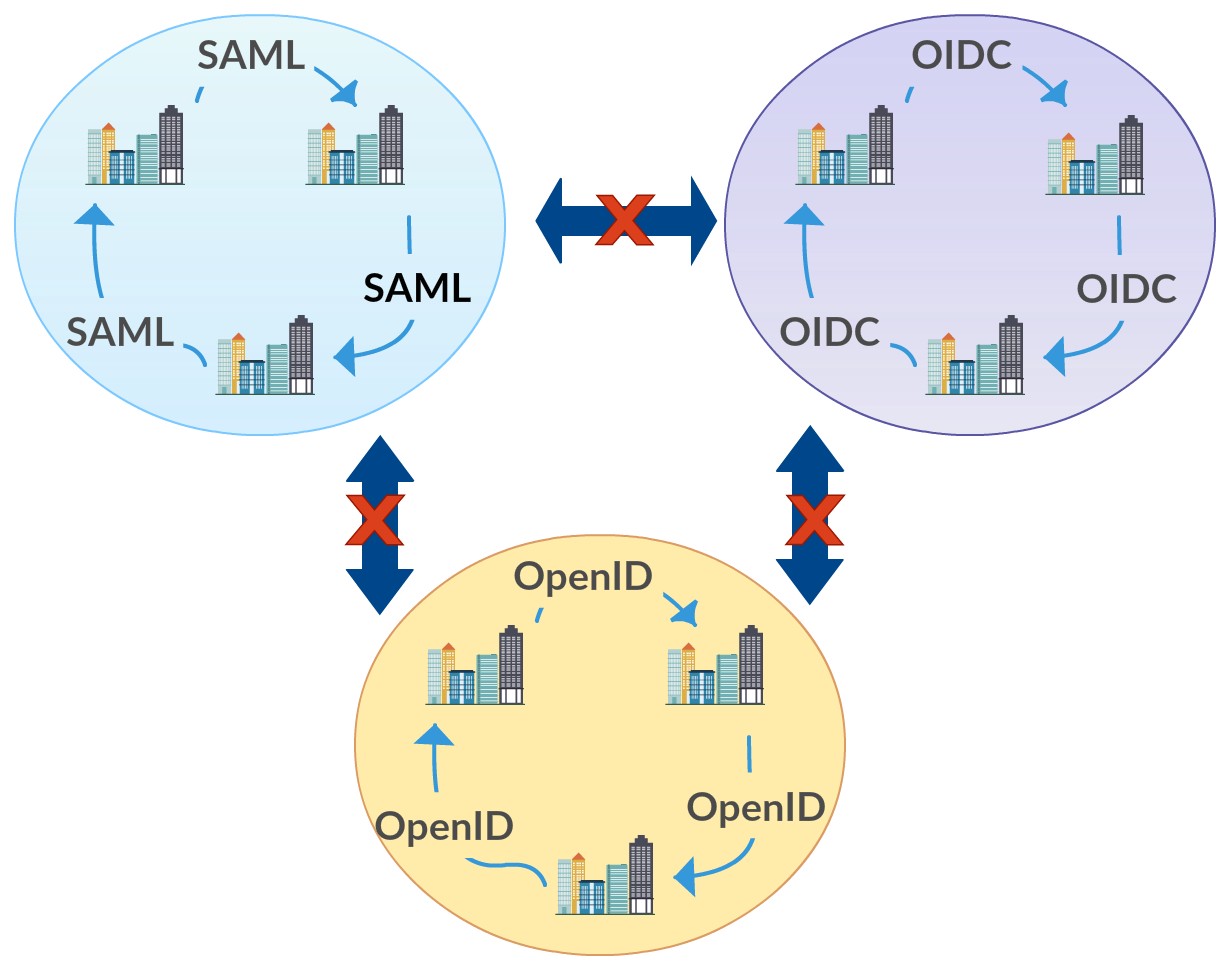

Partners, mergers, legal entities, government entities, customers all need to work together in this era, while honoring the boundaries they should work within. This is with link to my previous post on challenges of future IAM requirements arising with increased interchangeability requirements between diversified parties. Challenges of Future IAM (concerned with Mergers , Acquisitions, Startups) -http://pushpalankajaya.blogspot.com/2017/07/challenges-of-future-iam-concerned-with.html Future of Identity and Access Management (IAM)- http://pushpalankajaya.blogspot.com/2017/07/future-of-identity-and-access.html This need is much more emphasized with the new regulations such as PSD2 in EU region that is putting foundation for Open Banking. While these standards define guidance for implementation interfaces, End user authentication and authorization Third party authentication and authorization Identity mgt of internal staff, has hidden needs of identity mediation. Federated